The Erotic World of Macroeconomic Cycles

The Least Sexy Post That Might Save Your Creative Career

Last time, I talked about what creatives can learn from other professionals up and down the film and TV production pipeline. I discussed how being well-versed in different creative disciplines doesn’t hinder your core skillset; it actually improves it.

It was a pretty good post, you should check it out:

Today, I’m going to explain how - in order to sustain a career in entertainment - you need (need) to gain a deeper understanding of the global economy as a whole.

So, like, buckle up, or whatever.

Now, I am not an economist or a financial expert. But I do know people, and I understand the basic principles underpinning the U.S. economy and capitalism in general.

If the past 4 sentences have soured you on the idea of reading this post, I implore you: Please keep reading. I promise I will make this as accessible - and sexy - as possible. Plus, I promise there will be plenty of amusing stick figure illustrations.

If you’re lucky, maybe one of them will show their stick figure genitals 😏.

In this Episode:

Why entertainment mirrors the same economic cycles that topple nations

How risk aversion, FOMO, and consolidation are reshaping what gets made

Why creators can't raise prices like other businesses (and what that means for you)

The hidden macroeconomic forces behind your favorite show's cancellation

How to position yourself as the "upstart" in entertainment's historic shift

On Fractality and Abstraction

If these illustrations are doin’ it for you, spread the love!

Let’s Get Fractal

“Fractality” is a probably-made-up word, but I like it because it embodies a principle I find profound and fundamental:

Nearly all structures and systems in the physical world exhibit similar patterns at different scales.

Entertainment is an industry that is part of an economy which is maintained by nations of people.

If you look closely, you’ll notice the same patterns reflected in every level of this system: The industry, the economy, the nation and its people.

I’ll explain the types of patterns in a moment, but for now, I’ll just say:

In order to fully understand one level of a complex system - like the entertainment industry - it’s crucial to examine the system as a whole, including the other levels within the system (e.g. the economy and the society powering it). Otherwise you’re only getting part of the picture.

Examining the industry without considering the underlying economic structures would be like taking an architecture tour of the Empire State Building by starting - and ending - in the boiler room.

So let’s start exploring these other levels by talking about the steamiest topic I can think of: Macroeconomics.

On Macroeconomics (Prepare to be Aroused)

Ray Dalio is an American billionaire hedge fund manager, a bestselling author and a devoted practitioner of transcendental meditation (no, seriously). He has recently argued that capitalism needs to be reformed and called the widening wealth gap in the U.S. a national emergency.

In other words: I wouldn’t label him as one of “those” billionaires.

He also wrote a book that I reference from time to time called Principles of Dealing with the Changing World Order. He’s written a whole series of these “Principles” books, but I’m going to focus on that one.

In the book, he describes how economies and nations inevitably rise and fall based on large, 75-100 year debt cycles. In a nutshell:

A nation fosters strong leadership, education, innovation and competitiveness

Productivity and wealth rises

The nation dominates global trade and their currency grows stronger

The nation accumulates debt and wealth inequality grows

Political division rises and populism spreads

The nation’s global influence wanes

The nation experiences internal or external conflict

A new, rising power supplants the incumbent power

What Dalio discovered is that this same cycle plays out at every level of human organization - from families to companies to entire civilizations.

In business, it looks like this: Scrappy upstarts disrupt bloated legacy companies using new technology or methods, then eventually become the bloated legacy companies themselves, ripe for the next disruption.

That's exactly what's happening in entertainment right now.

The entertainment industry obviously faces headwinds unique to it, but the struggles faced by business leaders in TV & Film - and by extension the creatives they hire - echo the challenges faced by the economy as a whole.

Understanding these macro-challenges can help creative professionals anticipate coming storms before they hit. Below, I’ve outlined a few of these economic factors and how they relate to the TV & Film industry.

STEAMY Economic Factors Influencing Entertainment

Risk Aversion

The most influential companies in the U.S. economy are no longer putting their resources towards all things risky and new. Now that protectionism and efficiency are the norm, even companies with a historical track record of encouraging risk and discovery are cutting the cord on taking chances.

Google used to have a policy that encouraged employees to devote 20% of their time towards exploration of new ideas. According to Google comms, this policy still exists, but - especially recently - employees say otherwise.

What about their investment in AI? Surely that’s a risky bet, right?

It might be if they were the only company doing it. But now that every company has sunk tons of investment into the technology, it would actually be more risky to get left behind in development of the tech.

Instead of acting as a commitment to innovation, AI investment has become an indicator of risk-averse herd mentality.

Risk Aversion in Entertainment

I don’t need to tell you that risk aversion has eaten to the core of Hollywood. Studios at all levels have doubled down on Existing IP, sequels and reboots, and originals are struggling at the box office.

I’ve spoken in the past about how risk aversion begets disinterested TV viewership which begets more risk aversion in a self-propagating cycle.

I would argue this risk aversion is learned behavior from business figureheads at organizations in other verticals.

This is just a theory out of my own head, but my logic follows below:

Studio heads answer to shareholders, many of whom aren’t well-versed in business practices for creative industries. These shareholders see declining market value and their knee jerk reaction is to cut spending, increase efficiency and take fewer risks.

But nothing could be more counterproductive for an industry that relies on all things new and authentic.

While Apple can introduce small, incremental hardware improvements and keep selling iPhones, Hollywood has gotten beaten to shit by not providing something new and fresh to audiences.

Remember that risk aversion comes in waves. “Risk-on investment” describes a period characterized by a high appetite for risk and a strong focus on scaling and advancement as opposed to efficiency and survival.

What This Means for You

Based on anecdotal evidence of recent production trailer sightings in my neighborhood and conversations I’ve had as a result of building entertainment software, I believe risk aversion in creative development has (finally) peaked. I think we’re on the cusp of starting to see more original content getting bought and made (for TV and probably film, too).

That said, we may never again see the same volume of scripted TV production we saw in 2022.

Creative Strategy: Now is the perfect time for low-budget, high-concept content. Explore new distribution mechanisms where risk aversion doesn’t apply (e.g. YouTube).

FOMO & Bubbles

FOMO is a fundamental human tendency to chase trends - e.g. rallying stocks - out of a “Fear Of Missing Out.” If the opportunity exists to make 100x your investment, you don’t want to be the idiot who didn’t invest.

People who fall victim to FOMO mentality will assign value to things not out of respect for the fundamental strength of that thing, but simply because of the interest generated by other people.

This ties directly to risk appetite because in times of high risk tolerance (See: The Gold Rush, the speculative bubble of the 1920’s, the Dot-Com boom, and the real estate bubble that led to the 2008 Financial Crisis), people will abandon reasonable risk analysis in exchange for speed of execution. They’d rather have their money tied up in a risky asset than miss a potentially valuable outcome.

If enough people fall prey to FOMO thinking, a speculative bubble occurs where the price of an asset grows well beyond its fundamental value.

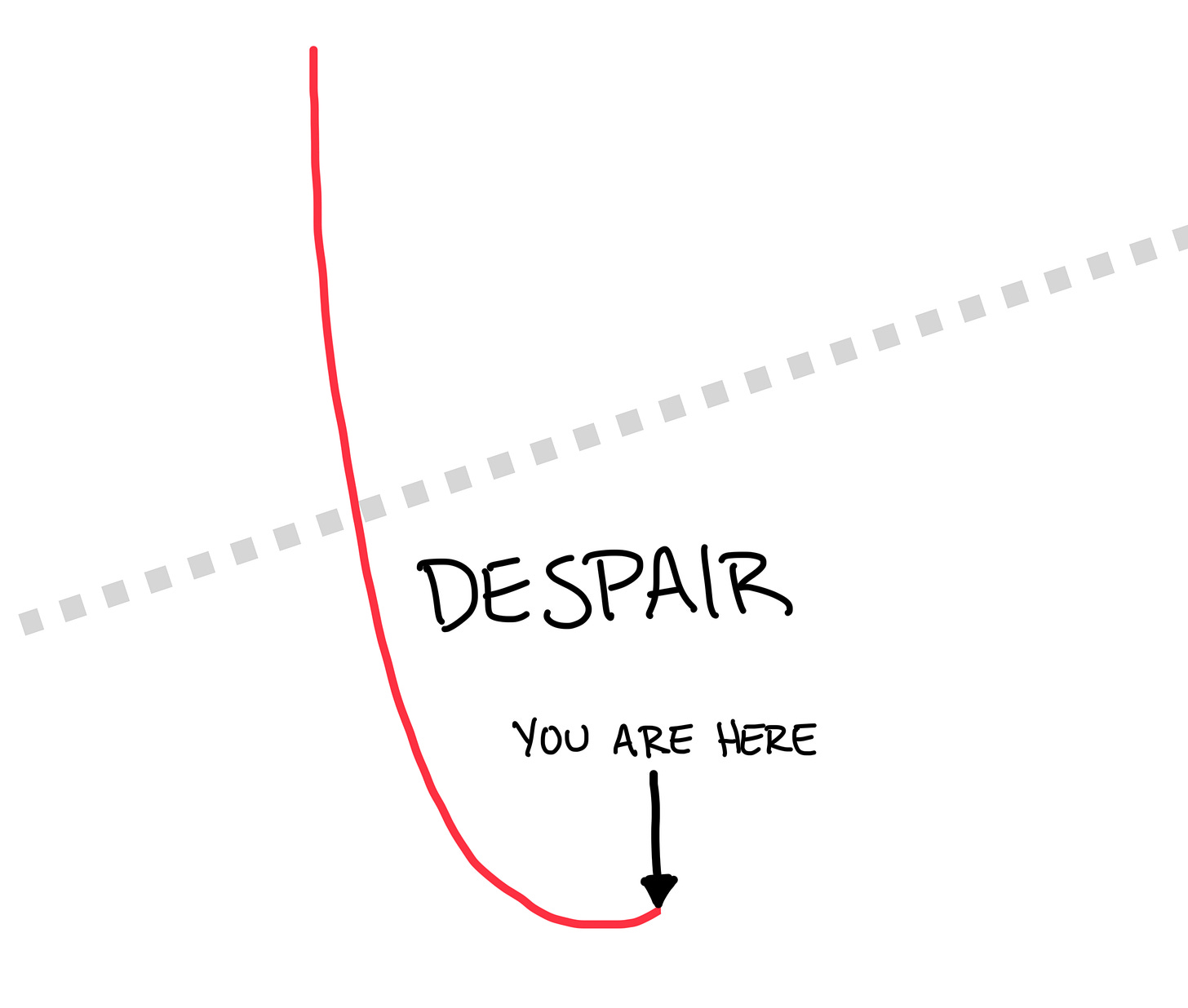

This trajectory of the bubble’s growth is represented in the following chart, which demonstrates the different stages of a bubble forming and popping:

If you look at systems built by humans, you will start to see this chart everywhere, from the real estate market to crypto investment to sourdough bread circa 2020. You could even argue hair trends follow this pattern. It is fundamental not just to economic markets but almost all man-made trends.

FOMO & Bubbles in Entertainment

The entertainment industry encountered mass FOMO when streaming platforms started gobbling up whatever content they could find in order to compete with other streaming platforms. They didn’t want to get left behind in the rapidly expanding streaming market, so they paid top dollar for talent and the volume of production spiked. This led to a peak of close to 600 scripted shows being produced in 2022 (AKA “Peak TV”).

Naturally, All Bubbles Must Burst™, and production volume has since plummeted. In case you haven’t felt this acutely, we are now in the “Despair” phase of the above chart, and we are in the process of reverting to the mean.

What This Means for You

Like many economic trends, this one is cyclical. That means you are here:

…which feels scary until you realize that you’re about to be here:

If that doesn’t induce optimism, I don’t know what will.

Creative Strategy: Zig while others zag. If everyone’s moving to YouTube, consider other platforms for your writing, e.g. self-publishing fiction on Substack or staging live / interactive performances.

Consolidation

Consolidation is the practice of bringing two or more entities into a single combined entity that (ideally) is larger, stronger and better-adapted to the surrounding business ecosystem. Mergers and acquisitions (M&A) are two common forms of consolidation in the world of business.

While there are certainly acquisitions (typically those by big tech companies) that raise the specter of monopolistic practices, a healthy M&A market typically indicates a healthy capital ecosystem, as larger companies invest in smaller ones to grow their business or expand into new markets.

These acquisitions can also provide “liquidity events” where startup founders and employees - many of whom have spent countless years building their companies - are bought out for life-changing sums of money. This is a model meant to incentivize innovation and reward entrepreneurial risk-taking.

Notably, the number of mergers and acquisitions has declined in recent years due to rising interest rates, economic uncertainty surrounding inflation, and pricing volatility. The expectation that this trend would reverse has been slow to materialize.

Consolidation in Entertainment

In entertainment, recent talk of consolidation has typically been painted with a brush of contraction and desperation. Instead of these acquisitions being born of opportunity, they are born out of opportunism: The acquiring company wants whatever assets the acquiree has, and the price is too good to pass up.

Some examples include:

Fortress Investment Group acquiring Curzon for 5 Million dollars and Vice Media, who were in Chapter 11 Bankruptcy at the time.

The AOL-Time Warner merger disaster from 2001, AT&T's $85 billion acquisition of Time Warner in 2018, and then the spinoff/merger creating Warner Bros. Discovery in 2022… Come to think of it, Time Warner has been on the receiving end of some really brutal deals, including their current debt-heavy predicament.

The 2014 purchase of ad server FreeWheel and the 2018 AT&T purchase of ad-tech platform AppNexus, both of which represented “Oh shit, we need to compete with Google somehow” moments.

This pattern suggests an unhealthy market full of capsizing ships that need to be bailed out / towed to shore / choose your nautical metaphor.

In breaking news, Disney this week announced mass layoffs of hundreds of employees, many in the Hulu/ABC division.

Development, marketing and casting were all impacted, and after Disney+ recently rolled Hulu into their streaming platform, it makes you wonder if the next logical step is to merge ABC/Hulu and Disney+ under the same roof.

This kind of internal consolidation is brutal - both for the people who get cut and for the survivors left to do more work with fewer resources.

What This Means for You

Contraction-oriented mergers and acquisitions can spell bad news for a struggling industry. If you plan to remain in traditional media & entertainment, this flavor of consolidation could mean fewer opportunities for growth and shakier career stability. But A: If you’ve made it this far, you should be used to that and B: If you’ve read HNTBATVW before, you already know some strategies to help insulate yourself against this outcome.

Creative Strategy: Find other creatives to collaborate with. Displaced creative professionals are hungry to make stuff and mega-merged companies aren’t giving them the opportunity to do so. Go out and find the DP and director and actors who will be your future collaborative team.

Widening Wealth Gap

The below is based on my interpretation of Ray Dalio’s study of the rise and fall of nations as presented in Principles for Dealing with the Changing World Order.

In it, Dalio argues that a widening wealth gap is an inevitable outcome of any economic system + time. It’s a compelling argument and a really eye-opening book. If you don’t want to read about debt cycles and inflation indicators, you should watch this video, which is super digestible and has deeply influenced the way I think about society and the world economy:

We’ve probably all heard that wealth inequality is rising (which is true).

Obviously, this is not a sustainable model. That is unless we think the ultra-rich can maintain a complex and globally-connected economy entirely via the trade of yachts, country club memberships and high-end watches.

In the 500 years that capitalism has been around, the wealth gap has been through cycles of gradual widening followed by a sharp (often violent) collapse as illustrated in the chart below:

No matter how prosperous a nation is, a widening wealth gap inevitably leads to a decline in living standards for the middle class. When this decline gets bad enough, people take the economy back and force the wealth gap to return to a sustainable level.

This can happen violently, as was the case with The French Revolution, or this can happen peacefully, as happened in The New Deal. Remember that top-end marginal tax rates prior to The New Deal were 25% and climbed as high as 94% during WWII.

The question isn’t “if” we see the wealth gap return to reasonable levels, but “When,” “How,” and “How quickly.”

Growing Wealth Gap In Entertainment

A lot of publications have written about the decline of “Hollywood’s Middle Class”:

A couple examples here and here.

It does seem like they’re not making mid-budget movies anymore, and it also feels like middle class professionals are the ones getting hit the hardest in the current contraction.

Also: Wealth inequality isn’t just about income. It’s also about spending. Not only are we seeing greater income inequality, we’re also seeing that reflected in purchases.

What This Means for You

A hollowing out of the middle in entertainment means that it will be harder for new entrants to find creative careers, and harder for existing creatives to get their projects off the ground.

But as I’ve said countless times in the past, opportunity abounds for anyone willing to think creatively about finding and maintaining an audience. It’s not just about looking to YouTube and Social Media. It’s about understanding the storytelling principles that captivate people and applying those same principles to your career.

Creative Strategy: As the middle disappears, building niche audiences will become more valuable than attempting to find mass market appeal. Build an audience around the weird stuff that interests you. The more specific, the better.

Interest Rates & Capital Costs

Interest rates determine how expensive it is to borrow money. When rates are low, companies can afford to take bigger risks because the cost of financing those risks is low. When rates go up, investment decisions get scrutinized due to the cost of interest. At the time of this writing, the U.S. Bank Prime Loan Rate is 7.5%, meaning you’re paying back $7.50 for every hundred dollars you borrow #basicarithmetic.

Interest Rates & Capital Costs in Entertainment

From 2010-2021, interest rates hovered near zero in what many called ZIRP, or the “Zero Interest Rate Phenomenon.” This created an environment where "cheap money" enabled the rise of Peak TV: Why worry about whether a show will be profitable when you can finance it for practically nothing?

Then, when the Federal Reserve began raising rates in 2022, suddenly every pilot had to justify its existence with hard ROI calculations instead of vague promises about "building the platform."

This explains why we’ve seen mass cancellations, shorter seasons, and a return to proven IP. It’s not just creative risk-aversion. It’s a math problem with no easy solution.

What This Means for You

There is greater focus on efficiency than ever before, and if you can demonstrate an ability to tell a story without all the bells and whistles of traditional standards of “high production value,” you can position yourself as a valuable creative partner.

Creative Strategy: Don’t just think of creative stories to tell; think of creative ways to tell your story. This is the type of environment where innovative production techniques are born, so go out and experiment!

Inflation

Inflation isn’t just about the cost of eggs. It means every input cost for businesses rises simultaneously.

Inflation's Impact on Entertainment

Entertainment doesn’t behave like the rest of the U.S. economy. It faces unique constraints that limit its ability to remain profitable as expenses rise.

For instance, network TV can’t just raise the price of a TV episode or charge more for a YouTube view when crew wages and equipment costs spike. And because a lot of entertainment revenues are driven by advertising, programming is getting squeezed from both sides: The purchasing power of advertising budgets decrease while production costs rise.

What This Means for You

Inflation creates opportunities for efficient creators who can do more with less. As I’ve spoken about in the past, this benefits jacks of all trades who are capable of handling multiple steps in the production pipeline.

Creative Strategy: Similar to the aforementioned adaptation to rising interest rates, now is the time to become an efficient creator instead of just a writer.

Efficiency and cost controls can be sexy.

Hope Remains

We seem to be in the “Despair” phase of multiple economic cycles simultaneously, and we should be okay with that. There are two important things to consider when examining these patterns:

The nature of cyclicality means we’re not going to be here forever. This is something I talk about in my post This is not The End. It’s only a matter of time before things turn around and the market improves for creative work.

Crisis breeds opportunity. Historic moments like this create the biggest wealth transfers, and the people who benefit aren’t necessarily the most experienced or the most well-connected; they’re the ones who approach the new reality with courage, flexibility and grace.

Remember the upstart cycle discussed at the top?

Established entities grow bloated and upstarts supplant them using new technologies and business methodologies.

We’re witnessing this pattern play out in real time. Creators are usurping the audiences that once belonged exclusively to large studios. The least nimble of these studios are rife with risk-aversion and bloat, and they’re left helplessly watching as the next great cycle appears in their rearview mirror, rapidly approaching.

So when you look at the work you do, when you look at your creative aspirations and your career goals, you need to ask yourself: Are you going to be standing on the sidelines, watching this historic shift zoom by, or are you going to be one of the Upstarts that drives it?

I know my answer.

The second one. The one where I’m driving.

Next time, we’ll dig into why the biggest trends of the next 5 years are going to be really, really small… Make sure to subscribe to get that one delivered to you.

Stay tuned,

Jon

another fun and enlightening one !!